Welcome to San Diego Blog | January 24, 2010

Downtown San Diego Condo Sales Update

The median sales price for a downtown San Diego Condo or downtown San Diego loft is down 11.7 from a year earlier. The median price came in at just $365,000, but the numbers are difficult to rely on. The difference between what is selling now and a year ago is largely driven by the financing available for home buyers. We are seeing more of the lower quality, more economical, downtown San Diego condos for sale than we are the luxury high-rise condos. Lenders continue to tighten their guidelines on condos and with the many downtown San Diego condo projects that experience litigation, we often see that most lenders won’t even lend on these buildings.

One group that has had success with lending on condos downtown San Diego that are in litigation is MetroTrust Mortgage. Steve Fagerwold just closed the first loan we have seen close at the El Cortez San Diego in Cortez hill in the past 3 years. Values in this building are a prime example of what can happen when lenders make financing virtually impossible. The values in the El Cortez are down over 50% from just four years ago because most local San Diegan’s looking to live here just don’t have the cash to spend and were not FHA approved. Investors don’t want to buy here because their ability to flip the properties is hindered by the litigation.

Another adversity that has contributed to the decline in the median sales price of condos downtown San Diego is that we have experience a lot of issues with inexperienced appraisers writing appraisals in a market with which they are not familiar. When legislation added the Home Valuation Code of Conduct (HVCC) this past year, it basically stripped loan officers of being able to order appraisals through qualified appraisers that were familiar with downtown San Diego properties. Now it is not uncommon to have appraisers drive an hour to show up to do their first downtown San Diego appraisal ever.

We have actually represented multiple buyers that had agreed to buy a property at a particular price that was in line with the sales comparables and the appraisal reports came back as low as 10% below the agreed upon price. In the majority of these cases, the seller actually accepted the lower price, therefore sending the market even lower. The sellers in many cases are the same banks that are sending out the appraiser so it just makes no sense! We have seen Bank of America shoot themselves in the foot on multiple occasions where they have sent out their own Landsafe appraisers.

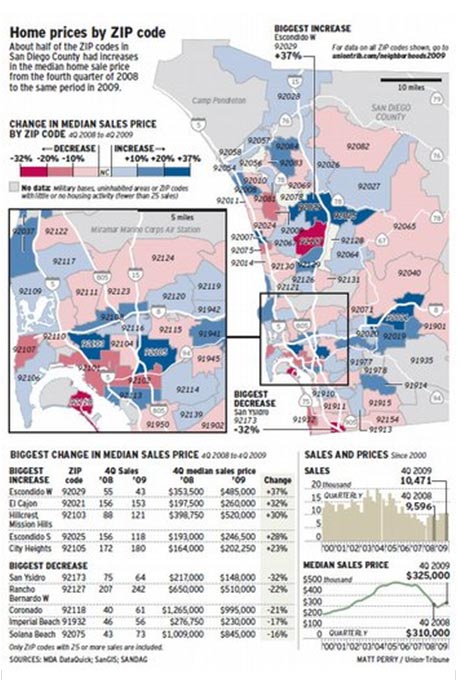

Across the county, we are seeing numbers all over the place. Veteran real estate consultant, Alan Nevin, from Marketpointe Advisors said the local housing market is becoming more stable, but he noted that the quarterly figures do not show a clear trend.

“I was hoping to find a pattern, and there was no pattern,” Nevin said. “Even in neighborhoods where there was a lot of activity, you would have thought, with 300 to 400 sales, you could be pretty reliant on the accuracy of the numbers. I’m not seeing that.”

The bottom line right now is that there are still great deals out there in all neighborhoods of San Diego so if you are ready, the time is now. Seach San Diego listings and decide if the time is right!

Read more about other San Diego real estate statistics.