Welcome to San Diego Blog | February 26, 2021

San Diego Housing Report

No Top in Sight

Many buyers wonder if they are overpaying as real estate prices continue to soar to record levels, yet that is not what the data shows.

Values Rising

The market velocity is extremely fast, and it is a Hot Seller’s Market where values are rising swiftly and multiple offers are the norm.

At the beginning of the COVID-19 pandemic, everybody rushed to their local supermarket to purchase toilet paper. At Costco people waited in lines for an hour prior to opening just to get their hands on one of the prized bulk packages of Kirkland Bath Tissue. There was a run on toilet paper. In no time at all, the shelves were empty and many worried that their supply at home would run out. As everyone agonized over their personal toilet paper inventory, little did they know that the tissue plight would foreshadow a similar dilemma in the housing market.

There are not enough homes on the market to keep up with today’s intense buyer demand. There is a run on housing. Homes are flying off the market faster than they are coming on, and the inventory has been dropping further as the year has progressed. Housing’s momentum lines up strongly in favor of sellers. In looking closely at the housing economic model of supply, demand, mortgage rates, affordability, buyer demographics, and market velocity, the data illustrates that the current trajectory of the housing market is not going to change anytime soon.

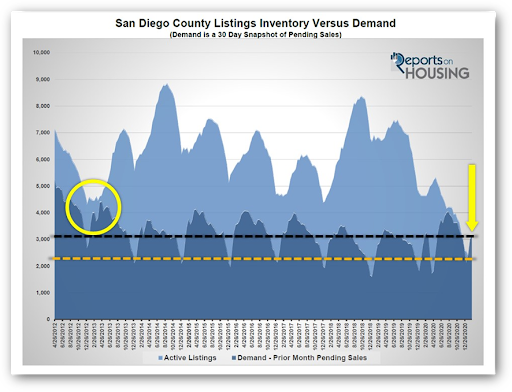

At the start of 2020, prior to any lockdown measures and the beginning of the pandemic in the United States, mortgage rates had dropped from 3.75% to 3.5%, an excellent level that had only been reached a few times since 2013. Throw in an increase in buyer demand due to the strongest demographic patch of prime first-time home buyers, 32-year-olds, in 26 years (which will continue for the next 4 years), it was no surprise that the market was hot in February 2020. The inventory was at its lowest level since 2013, a crazy year for housing, demand was at its hottest point since 2017, and the velocity of the market was the strongest since 2017. Then the pandemic hit, demand stalled and so did the inventory. Yet, as rates dropped to record levels, 16 record lows last year, demand heated up and the inventory continued to drop. In fact, the market dropped to its hottest point by year’s end with an Expected Market Time (the time between hammering in the FOR-SALE sign to opening escrow) of 30 days.

With mortgage rates remaining below 3%, a level never reached prior to last year, today’s housing market is one of the strongest on record, and it has everything to do with supply and demand. The current number of available homes to purchase is well below current demand readings. The active inventory today is at 2,286 homes, and demand (last 30-days of new escrow activity) is at 3,130 pending sales. There are 844 fewer homes available to purchase compared to current demand. Homes are flying into escrow as quickly as they are coming on. The Expected Market Time is at 22 days, the lowest level since tracking began in 2012.

For proper perspective, last year there were 4,652 homes available, and demand was at 3,137 pending sales. There were 1,515 more homes available to purchase than demand. The Expected Market Time was at 44 days; for mid-February, only 2013 and 2017 were stronger. In 2013, the hottest year in an exceptionally long time, the inventory was at 4,477 and demand was at 4,013. There were 464 more homes available to purchase compared to demand. The Expected Market Time was at 33 days.

With an Expected Market Time of 22 days, homes priced close to their Fair Market Values procure a swarm of activity, multiple offers, 10, 20, or even 30 offers, and ultimately sell for a bit more than the asking price, and in some cases a lot more. It depends upon the home. Buyers worry about paying too much, often the record for development. Everyone’s head immediately retreats to the last time there was a comparable buyer frenzy in housing, the years leading up to the Great Recession. However, there was over eight times the number of homes available to purchase in 2006, a year before the start of the Great Recession, 20,000 homes. Homes were far less affordable with mortgage rates at 6.5%. Lender qualifications were loose with a disproportionate number of subprime, zero-down, and pick-a-payment loans, tons of cash-out refinances, and fraudulent lending practices. The transgressions of the real estate industry ultimately led to the deep recession where values plummeted. In contrast, today’s housing has an extremely strong foundation with years of tight lender qualifications, large down payments, plenty of nested equity, and limited cash-out refinances.

Buyers should not worry about paying too much in today’s environment. Mortgage rates are below 3%, demand is unbelievably powerful, the supply of homes is at record low levels, and values are lined rising swiftly. The underlying ingredients that makeup today’s housing market are not going to change anytime soon. Instead, buyers should look at their family budgets and determine how much they can comfortably afford, and then aggressively pursue a home. Waiting is not really an option as home values are on the rise and mortgage rates are slowly rising right now as well.

A Tip for Buyers: In competing against a multitude of offers, sharpen your pencil, make the offer as agreeable as possible, and pack your patience. Sometimes an offer above the listed price is necessary to be the winning bidder. Stretching an offer by an additional $10,000 may be enough to get past the finish line. At today’s 2.81% mortgage rate, the additional $10,000 means that the monthly payment goes up by $41.14 and the down payment slightly rises as well. Remember, only one buyer wins the bidding war. For everybody else, it is back to the drawing board.

Active Listings

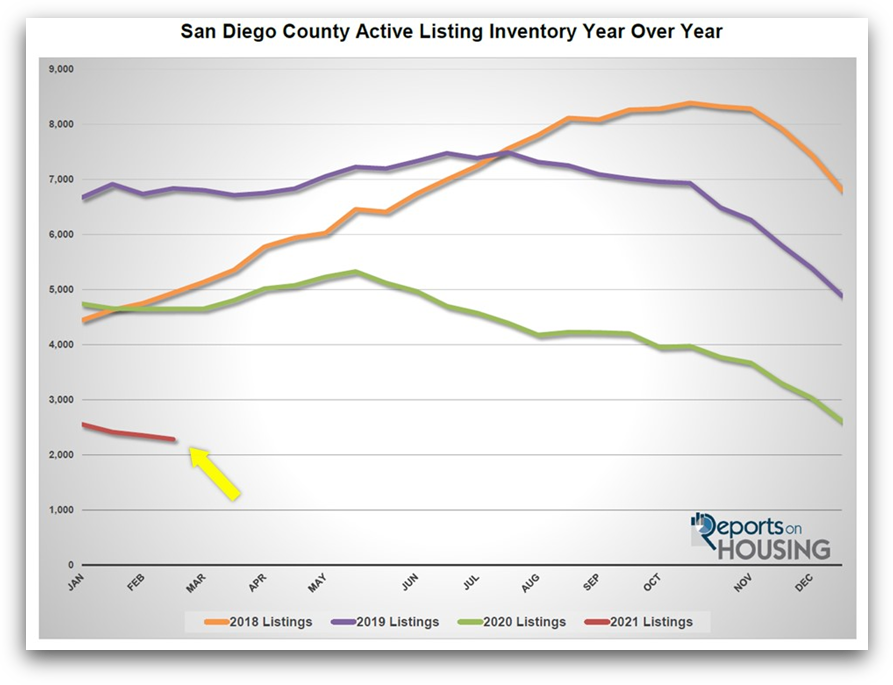

The current active inventory dropped by another 3% in the past couple of weeks.

The active listing inventory shed 69 homes in the past two weeks, down 3%, and now sits at 2,286, the lowest inventory level since tracking began in 2012. The low mortgage rate environment is going to continue to thrust this market forward. Homes are not coming on fast enough to satisfy current demand levels, which is why the number of available homes is dropping right now. Homes are coming off the market and into escrow faster than they are coming on. This will continue until the start of the Spring Market next month. More homeowners ultimately wait for the spring than any other time to place their homes on the market. With today’s ultra-hot housing pace, spring cannot come fast enough.

There are fewer homeowners coming on the market compared to the 5-year average. During January, there were 947 fewer new FOR-SALE signs in Los Angeles County, 22% less. This new trend is the same across Southern California. It is not COVID-19 that is currently suppressing homeowners from selling their homes; instead, it is the lack of available replacement homes that have many spooked about selling. Many are fearful there will be “nothing to buy,” limiting the number of homeowners willing to participate in a market with such an anemic level of available homes to purchase. Yet, there are great strategies to counter this argument. Sellers can agree to an offer to purchase contingent on finding a replacement property within a specified period of time. They can also rent back for a couple of months. With the market lining up so favorably for sellers, it is a lot easier for a seller to find a buyer willing to agree to these terms.

Last year in mid-February, there were 4,652 homes on the market, 2,366 additional homes, or 103% more, a little more than double. There were more choices for buyers last year.

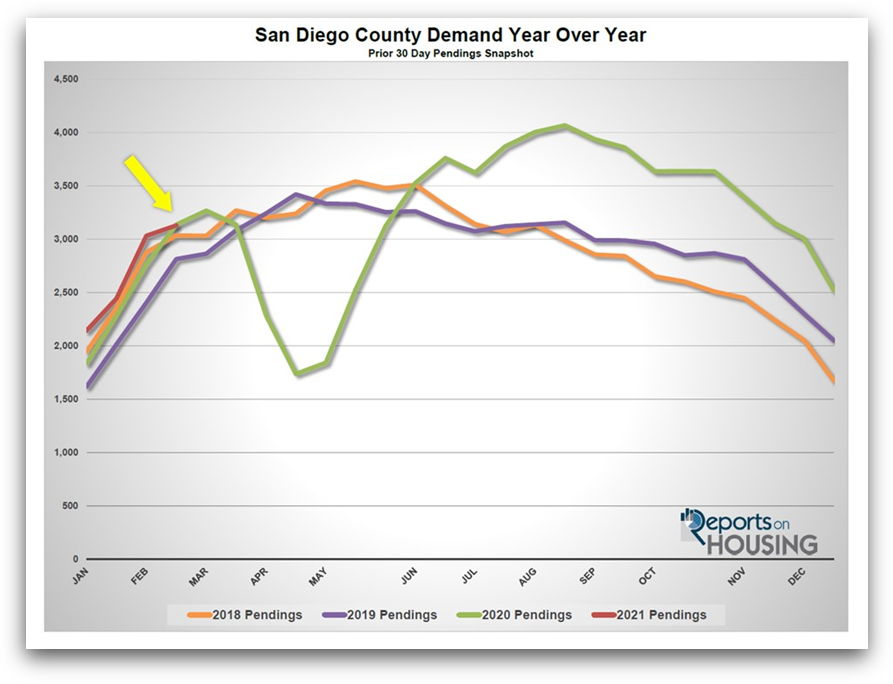

Demand

Demand picked up another 3% in the past couple of weeks.

Demand, a snapshot of the number of new pending sales over the prior month, climbed from 3,033 to 3,130 in the past couple of weeks, adding 97 pending sales, up 3%. Mortgage rates below 3% are still instigating today’s strong demand levels, however many homeowners are reluctant to place their homes on the market given the lack of available replacement properties. Since demand is a snapshot of recent pending sales activity, if there were more homes coming on the market right now, demand would be much higher than where it is today. The lack of available homes to purchase is limiting today’s escrow activity. Demand will continue to rise as more homes become available over the next couple of months and more homes come on the market during the spring. It will most likely peak sometime in May.

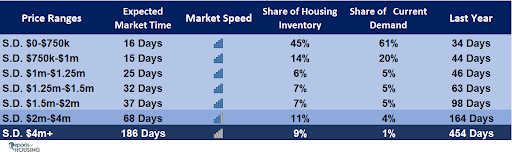

Luxury End

Luxury demand continued to rise in the past couple of weeks.

In the past two weeks, luxury demand for homes priced above $1.25 million increased, adding 29 pending sales and now sits at 437, up 7%, and its highest reading since October. At the same time, the luxury inventory dropped by 1 home, almost unchanged, and now sits at 804 homes. With demand rising, the overall Expected Market Time for luxury homes priced above $1.25 million decreased from 59 to 55 days in the past couple of weeks, its lowest level since tracking began in 2012. Luxury is firing on all cylinders and setting the stage for an unbelievable 2021 Spring Market.

Expect the luxury market to continue to improve over the next couple of months, peaking from mid-April to mid-May during the Spring Market.

Year over year, luxury demand is up by 124 pending sales or 40%, and the active luxury listing inventory is down by 458 homes, or 36% less. The Expected Market Time last year was at 121 days, substantially higher than where it stands today.

For homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time increased from 27 to 32 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 40 to 37 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 94 to 68 days. For homes priced above $4 million, the Expected Market Time increased from 179 to 186 days. At 186 days, a seller would be looking at placing their home into escrow around August 2021.

Copyright 2021 – Steven Thomas, Reports On Housing – All Rights Reserved. This report may not be reproduced in whole or part without express written permission by the author.