Welcome to San Diego Blog | February 18, 2022

Selling Above the Asking Price

It is common for homes that are just placed onto the market to receive dozens of offers to purchase, pushing up home values at a rapid pace.

For over a century, the predominant way to sell a home in Australia has been by auction. The appeal of an auction is that homeowners believe they can get a higher price by forcing buyers to compete against each other in a bidding war. An auctioneer is hired to conduct the bidding process. The more that participate, the higher the price. It has been argued that the auction system has resulted in sky-rocketing housing prices.

In the United States, for the most part, homes are not sold by auction. Yet, talk to any buyer over the past couple of years and they would argue that the real estate purchasing process feels more like an auction than the conventional way of buying a home. There once was a time when homes generated only one or two offers and the overall temperature of the market was much different than today. With today’s extremely limited inventory and throngs of buyers interested in every home that comes to market, a bidding war develops. The asking price can be seen as the “reserve price,” the minimum bid acceptable to a seller. Often, offers that come in at the asking price do not excite many sellers, resulting in delays in response times until “better” offers come along.

Initially, record low mortgage rates paved the way for white-hot demand. An unbelievable 17 record lows were achieved after the country slipped into a pandemic back in March 2020. The lowest rate was reached during the first week of January 2021 at 2.65%, according to Freddie Mac’s Primary Mortgage Market Survey®, which dates to 1971. But recently, rates have dramatically climbed from 3.05% on December 23rd of last year to 3.55% as of February 3rd. That’s half of a percent in a very short period, and they are poised to rise further as the U.S. economy continues to improve.

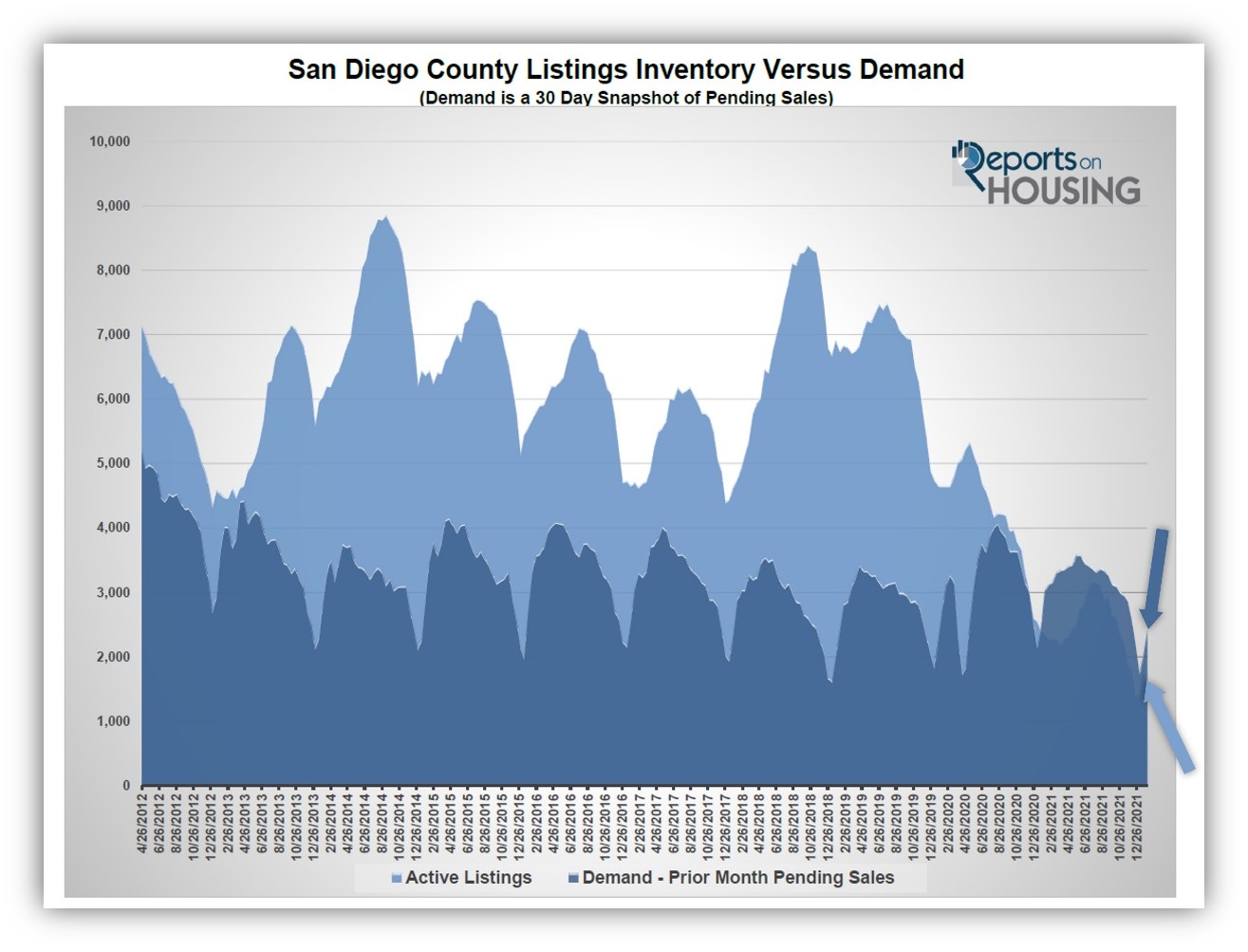

It is no longer low mortgage rates that are stoking the fires of demand; instead, it is the severe inventory shortage. The inventory has plunged to record lows, starting off the year at 1,254 homes. Today, it has risen slightly to 1,537 homes, but that is still far from normal. The three-year average prior to the pandemic (2017 through 2019), there were 5,400 homes, an additional 3,863, or an extra 251% more, more than triple. There are simply not enough homes available to match demand.

Demand, the number of pending sales over the prior month, has exceeded the inventory level since January of last year. That’s a full year where demand has been outpacing the supply of available homes. It is no wonder that the inventory has fallen to an incredibly catastrophic level. There really is nothing available to purchase. Every home that enters the fray is inundated with showings, and, if not priced ridiculously out of bounds, generates plenty of offers. With so much buyer competition, sellers get to call all the shots. Buyers have been willing to wave inspections, wave the appraisal contingency, offer a 60-day rent back, and close in a timeframe that is most suitable for the seller.

The current demand is at 2,407 pending sales. Demand is 870 higher than the active listing inventory. The three-year average for demand prior to COVID was 2,785, significantly lower than the three-year average for the active inventory of 5,400 homes, 2,615 lower to be exact. That illustrates how demand is normally a lot lower than the inventory, not the other way around, as is shown in the chart above.

When demand outstrips the supply, it indicates that it is an insane, outrageous, red-hot housing market where buyers are pit against each other and Darwinism ensues, survival of the fittest. In today’s market, typically the buyer that is most qualified with a great job, large bank account, strong credit score, willing to remove contingencies, and bend to a seller’s every whim is the victor. That includes offering more than the asking price. In January, 56% of all closed sales in San Diego County sold above their asking price. And, it is not isolated to the lower end. If a home is priced right, regardless of the price range, a bidding war follows.

The auction-like atmosphere will continue if inventory remains at ultra-low levels. Higher rates are not yet deterring buyers from purchasing, but if they continue to rise, it will be a totally different story down the road.

A WARNING TO SELLERS: Carefully pricing a home is crucial to obtaining the best outcome regarding price and terms. Pricing at or slightly above the last comparable pending or closed sale will expose the home to the largest buyer pool. The auction that follows will have buyers competing against each other to achieve success. This results in sales prices above their asking prices, and in many cases, way above their asking prices. Stretching the initial asking price considerably above the comps may still result in achieving the ultimate goal in selling; HOWEVER, it will be at the expense of not obtaining the highest and best price and terms.

– Copyright 2022 – Steven Thomas, Reports On Housing – All Rights Reserved. This report may not be reproduced in whole or part without express written permission by author.